How To Scan Stocks For Swing Trading

Contents

You will still need to carefully analyze the tradability and confirm the set-ups before considering a trade. Not all scanners are accurate or reliable, especially pattern based scanners. When used improperly, scanners can spread a trader too thin between candidates and create more opportunities to lose money quicker. A trader should be well versed in the criteria and test how well a scanner actually screens to gauge how reliable it is.

Just send me an email at , and I’ll show you how to get access to that indicator. And then you can click on edit here and you can go ahead and edit. So if you are quite sure what to type in, you just go over here, and you got all this stuff that you can add on. You can add a filter and then you can just go right in over here and you don’t have to manually type it in.

Trading Psychology Masterclass

Selecting the timeframe while scanning for trading opportunities is perhaps one of the biggest confusion a newbie technical analyst has. You can choose many timeframes from – 1 minute, 5 minutes, 10 minutes, 15 minutes, EOD, Weekly, Monthly, and Yearly. Scripting you strategy – Pi has a scripting language employing which you can code technical strategies and backtest the same on historical data. Please do note, on Varsity we will soon include a module on building trading strategies and scripting.

Kindly note, the suggestions I have put forth in this chapter are based on my trading experience. Volume Dry Up and Pocket Pivots are some of the most powerful precursors to big moves in the stock market when interpreted correctly. Often called VooDoo, for the acronym VDU, by discoverers… After all, most of us are used to seeing price candlesticks separate from volume bars below on a chart. But if you want to be long and take advantage of these events, you need to be able to find stocks with a high short interest. Depending on your preference, the market may be presenting more opportunities in one direction or the other.

In addition to draining more resources and the timeliness of results, you will also have to contend with potentially a lot more candidates to analyze. Your customized desktop scanner may spit out 3 candidates within seconds of qualifying whereas an online scanner may spit out 50 candidates within minutes of qualifying. With your watch list scan, you should already be familiar with the stocks and their tradability, whereas many of the stocks on the universal scan may be completely foreign to you.

Remember never to risk more than you’re willing to lose, because that is one of the most important pieces of investment advice that a swing trader can learn. Simulated trading strategies and virtual trading assistants can assist you as a swing trader by providing pricing alerts and curated workspaces to make your life more efficient. Investors are commonly looking for ways to help them find profitable swing trades in various types of markets. If the market is strong, you can wait for the channel line to be hit. If it’s weak, grab your first profit while it’s still there. An experienced trader may shift his tactics and hold a little longer, perhaps until the day when the market fails to make a new high.

Scan #1: Turbo Breaks Up & Down

A swing trading journal is not only about what happened in the past. Make sure that you reflect on what there is to learn from your experiences. Did you experience any difficulties executing your swing trades? Use an index of 1-5 to specify how much you struggled with sticking to your trading rules.

- If a trader captured one-half of the channel, it would be a 50% performance.

- The Relative Volume filter is great at finding stocks in play.

- When a stock pulls back into this zone, look to the left to identify support and resistance, trend lines, candlestick patterns, etc.

- An active swing trader usually keeps his trading position open for a few days.

- Some might suffer from too low volume, and others might simply be in the wrong market sector.

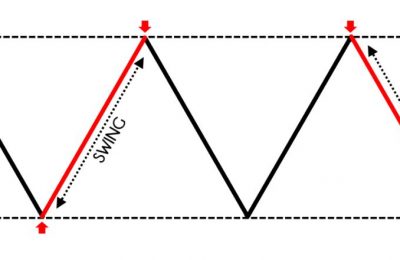

Yes, there are a number of special https://forex-world.net/ for swing trading. Some strategies include trend following, range trading, breakout trading, and scalping. When it comes to what technical analysis you should learn, we recommend that you don’t focus on learning what every pattern means, as it’s mostly incorrect information. The only thing you should care about is how the pattern performs in your tests.

Scan for stocks in an uptrend but pulling back towards their 20-day moving average

You can use it to scan for trading signals, and also perform advanced portfolio backtests. However, Multicharts is only a trading platform and requires that you connect to a live data stream. If you want to perform your trades through the Multicharts, you could also connect to a broker of your choice. As with all types of trading, you could incur substantial losses with swing trading. Now, if you have a robust trading strategy, your chances of success increase manyfold, but nothing is 100% secure.

The lookback period should be at least 6 months to 1 year for swing trading. If you aspire to become a technical trader, ensure you equip yourself with good charting software. I have mentioned this many times in this module; I will mention this for one last time – once you place a trade, do nothing until your target is achieved, or stoploss is triggered. Of course, you can trail your stoploss, which is a healthy practice.

Finviz is a stock screener that is specifically designed to work in your internet browser. Any and all information discussed is for educational and informational purposes only and should not be considered tax, legal or investment advice. A referral to a stock or commodity is not an indication to buy or sell that stock or commodity. Have traded at least 125,000 shares already on the day.

As such, it could be wise to start coming up with trading ideas that attempt to make use of the mean-reverting tendency of the stock market. However, in the case with the stock market, we know for sure that mean reversion strategies are easier to build than other strategy forms, as we’ve already shared with you. When the market has gone to much to the upside, we usually say that it’s overbought.

Users should limit the https://forexarticles.net/s to groups of stocks like watch lists or sectors, rather than the whole market to ensure proper functionality and offset performance slow down. With a smaller sample size, these programs can be customized to alert potential pattern triggers much quicker than a cloud-based scanner. They will require programming knowledge and fluency in the criteria selection process to customize the scans. In fact, I just went through it tonight when we had quite a few opportunities actually for it, a couple of them really good ones. But I take it with swing trading and day trading, the Rubberband Trade works on Forex, futures, stocks, ETFs, commodities. Anyway, be happy to give you that trade setup for free with all the entries, exits, all the details.

SMAs with short lengths react more quickly to price changes than those with longer timeframes. The Breakouts module is a great place for swing traders to start in Scanz. The Price Breakouts filter allows you to quickly spot stocks that are crossing above or below a moving average, which is a starting point for many swing trading strategies. These are more hands-on programs that can be time consuming to set-up for the user especially if programming knowledge is required, but the accuracy of the scans are the highest. Having the scanner monitor your 100 stocks in real-time compared to over 6,000 stocks makes a big difference.

In this section we wanted to https://bigbostrade.com/ some tips on how to manage not only your trades, but also the risks that you take. Due to this, you want to ensure that the stocks you trade have enough volume so that your orders will be executed efficiently, with as little slippage as possible. There are many methods out there that claim to deal with curve fitting, but in our experience no method is foolproof. Regardless of the method you choose, you have to be careful, and can never completely rule out the possibility that the strategy you’re going to trade is curve fit.

You have your paycheck coming in every month, and will survive regardless. The tightness of your filters will be the key to generating accurate results. If you are scanning for pattern set ups, make sure to validate how accurate the results are. If the scan is a pre-set one, then be aware of the flaw.

Bramesh Bhandari has been actively trading the Indian Stock Markets since over 15+ Years. His primary strategies are his interpretations and applications of Gann And Astro Methodologies developed over the past decade. Have traded at least 2 times as much as normal/expected in the last 1 minutes.